Confused whether or not to invest in Nykaa? This blog post will cover the business, financials and valuations and help you reach out on a decision.

• Nykaa Company Overview

Nykaa is an India based e-commerce business which was started way back in 2012 by Mrs. Fulguni Nayar. It has various stores selling cosmetic products, but the major revenue comes from the online business.

Let us now look at the business model of Nykaa to understand how Nykaa makes money.

• Nykaa Business Model

Nykaa is trying to create a marketplace, just like Amazon where different sellers can list their products under "Nykaa's name". In this process, Nykaa has already been able to collaborate with various fashion brands and cosmetic brands, including Lakmé and L'Oreal.

Along with that, Nykaa is focused on growing its own products under Nykaa fashion and cosmetics range under Nykaa Cosmetics.

• Nykaa Promotors

Mrs. Fulguni Nayar started out Nykaa in 2012 at the age of 50 years. Her children are also involved in running and growing Nykaa. Even though Nykaa is launching its IPO, the promotors will be offloading only around 1.6% of their shares. This clearly shows a strong confidence of the promotors in the business.

• Nykaa Financials

The financials of Nykaa are also favourable. The total sales have been consistently rising. Along with that, the company kept on reducing their losses every year and now has eventually become profitable. Also, the promotors will continue to hold more than 50% shares, even after the IPO listing, which is another positive sign.

• Nykaa Future Prospects

Nykaa operates primarily in the cosmetics industry, which is growing. It is further trying to penetrate into lifestyle and fashion industry. Once Nykaa becomes a monopoly, it will also have pricing power and thus increasing margins which in turn will lead to increased profits. Nykaa has already become profitable and has further growth prospects left to uncover.

Now, if you have developed interest in the company, then let us discuss about the IPO.

• Nykaa IPO date

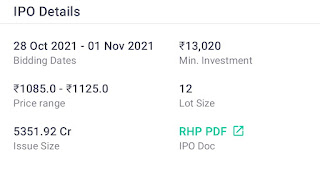

Nykaa IPO will be open to apply from 28th October 2021 to 1st November 2021.

• Nykaa IPO price band

• Nykaa IPO listing

Common Questions

• Why is Nykaa coming with an IPO ?

Nykaa's vision is to establish itself into a company that provides a complete ecosystem in the fashion industry, unlike a lot of IPOs where either promotors use IPO to earn money by selling their shares or pay off the debt. So, the reason in case of Nykaa is for business expansion.

• Is Nykaa IPO overvalued?

As per the P/E ratio, Nykaa does seem to be overvalued. But, at least the P/E ratio is positive because the company is profitable, unlike most of the digital businesses that come up with an IPO while being in loss. Also, as the revenues of the company increase, the PE ratio will adjust accordingly.

• Shoud I invest in Nykaa IPO for listing gains?

Nykaa is expected to give good listing gains. This is visible from the subscription rate:-

Along with that, the grey market premium is high and predicts around 50% listing gains.

• Should I invest in Nykaa for long term?

Nykaa seems to be a good stock to hold for the long term because of the following 2 reasons:-

- The fashion and lifestyle industry is in a growth phase and will continue to do so with lifestyle inflation. Going forward, Nykaa targets to capture the entire fashion industry. This includes consultation services, beauty advice and much more.

- Nykaa has already become popular among the common people and built a strong social media presence which is clearly visible in the IPO subscription rate of the retail segment. This also helps Nykaa to cut down the marketing expenses.

Do comment if you applied for the IPO and whether you got the allotment.

• Topics you might be interested in

- How to choose stocks for long term investment

- Swing trading approach

- Best dividend stocks

- TCS vs Infosys vs HCl vs Wipro FY22 Q2 Results Analysis

- Should I buy IEX for bonus

• Frequently Asked Questions (FAQs)

1. What is Nykaa IPO price?

The issue size of IPO is Rs. 5351 crores roughly at a price band if Rs. 1085-1125.

2. What is Nykaa IPO close date?

Nykaa IPO will be open to apply from 28th October 2021 to 1st November 2021.

3. When is Nykaa IPO listing?

Nykaa is expected to get listed on November 8.

4. How to buy Nykaa IPO?

Nykaa IPO can be purchased from any stock broker that supports IPOs. If you are looking out for a discount broker, you can use Groww.

5. How much is Nykaa IPO grey market premium?

The grey market premium is high as of now and predicts around 50% listing gains.

Thanks a lot for reading. Hope you had a good time and got some valuable information!

Comments

Post a Comment